Introduction

Bank safe deposit box is a highly secure container, typically located in a bank or credit union, designed to store valuable items and important documents. These boxes are housed within vaults that boast advanced security features, providing a level of protection that far exceeds that of most home safes. By buying a bank safe deposit box, you can ensure that your valuables are safe from theft, fire, and other potential risks. Bank Safe deposit boxes come in various sizes to accommodate different storage needs, offering both security and peace of mind.

What is a Bank Safe Deposit Box?

Bank safe deposit box is a secure storage container provided by financial institutions such as banks and credit unions. Its primary purpose is to offer a high level of security for storing valuable items and important documents. Unlike standard home safes, Bank safe deposit boxes are housed within vaults that have reinforced walls and sophisticated locking mechanisms, making them resistant to unauthorized access, theft, and environmental hazards.

These boxes are typically used to safeguard:

- Important Documents: Birth certificates, wills, property deeds, and insurance policies.

- Valuables: Jewelry, precious metals, rare coins, and collectibles.

- Digital Storage: USB drives, external hard drives, and other digital data storage devices.

- Family Heirlooms: Items with significant sentimental value that are irreplaceable.

The secure environment of a safe deposit box ensures that these items are protected from common risks such as theft, fire, flood, and damage, providing peace of mind for those who need to store their most treasured possessions.

Bank Safe deposit boxes are typically offered by financial institutions that prioritize security and privacy. Common locations include:

- Banks: Major banks, such as Bank of America, offer safe deposit boxes as part of their suite of services. They provide various box sizes and pricing options to meet different needs.

- Credit Unions: Many credit unions also offer safe deposit boxes to their members. These institutions often provide a range of sizes and competitive pricing.

- Private Vault Companies: Some specialized companies provide secure vault storage services outside traditional banking institutions.

When searching for a safe deposit box, terms like “safe deposit box near me” can help you find local options. For specific needs, you might consider contacting institutions Safewell to inquire about our safe deposit box offerings and availability.

What Do Bank Safe Deposit Box Keys Look Like?

A small home safe is a compact yet highly secure storage solution ideal for personal use. Here are a few reasons why investing in a small home safe is a smart decision:

Safe deposit box keys play a crucial role in ensuring the security of your stored items. Here’s a detailed look at what these keys typically look like and how modern access methods are evolving:

Description of Typical Safe Deposit Box Keys

- Flat Metal Keys: Traditional safe deposit box keys are often flat and made of metal. These keys are typically robust and designed to withstand tampering attempts. They usually have a distinct shape and size, which makes them easily recognizable.

- Unique Cuts and Grooves: Each safe deposit box key has unique cuts and grooves that correspond to the specific lock mechanism of the box. These intricate patterns are designed to provide a high level of security, ensuring that only the correct key can open the box. The uniqueness of the cuts and grooves helps prevent unauthorized duplication and access.

Mention of Modern Access Methods

- Key Cards: In addition to traditional metal keys, some banks and credit unions have adopted key card systems. Key cards are similar to credit cards but contain embedded chips or magnetic strips that interact with electronic lock systems. These cards offer a convenient and modern alternative to physical keys, often used in conjunction with other security measures.

- Biometric Access: Modern access methods also include biometric systems, such as fingerprint or retina scanners. These systems provide an additional layer of security by verifying the identity of the individual attempting to access the safe deposit box. Biometric access ensures that only authorized users can enter the vault area, further enhancing the safety of stored items.

Understanding the key types and modern access methods can help you make an informed choice when selecting a safe deposit box, ensuring that you find a solution that meets your security needs and preferences.

Are Bank Safe Deposit Boxes Safe?

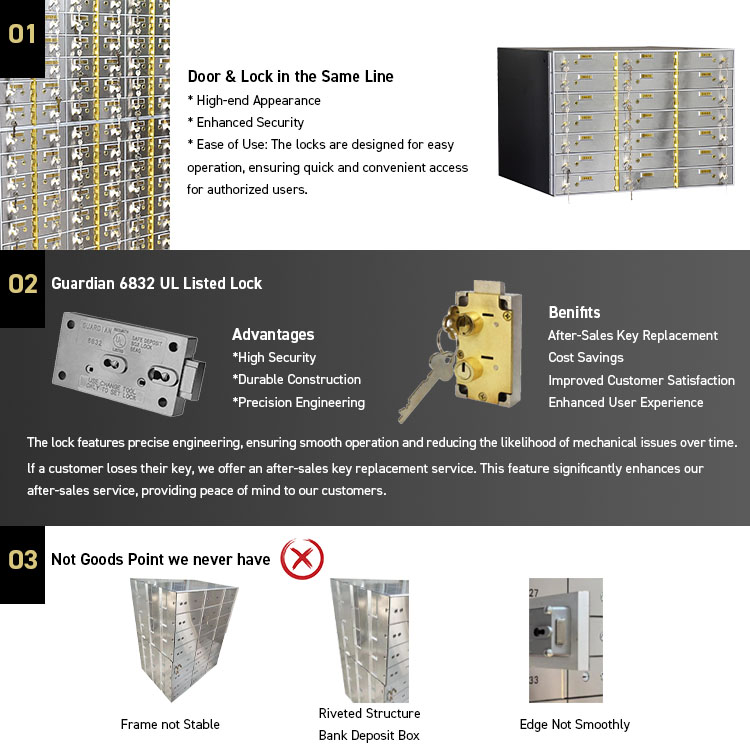

Safe deposit boxes are renowned for their high level of security, designed to protect valuable items and important documents from a range of risks. Here’s a closer look at the key security features that make safe deposit boxes a reliable storage solution:

Physical Security

- Vaults with Thick Walls: Safe deposit boxes are housed within robust vaults that feature thick, reinforced walls made of steel or concrete. These vaults are engineered to withstand physical attacks, including attempts to break in or tamper with the contents.

- Strong Doors: The vault doors are constructed from heavy-duty materials and are equipped with complex locking mechanisms. These doors are built to be highly resistant to forceful entry and unauthorized access.

- Complex Locking Mechanisms: Safe deposit boxes utilize intricate lock systems that include multiple layers of security, such as combination locks, key-based locks, and electronic systems, ensuring that only authorized individuals can access the box.

Surveillance

- Alarms: Banks and credit unions often equip their vaults with advanced alarm systems that detect unauthorized entry or tampering attempts. These alarms are designed to alert security personnel and law enforcement in the event of a breach.

- Security Cameras: Continuous video surveillance is employed to monitor activity around the vaults. Security cameras capture footage of anyone entering or exiting the vault area, adding an additional layer of security and deterrence against theft.

- Security Guards: Many institutions have security personnel stationed at key points, such as entrance areas and vaults. These guards are trained to respond to security threats and maintain a high level of vigilance.

Dual Control Access

- Both Renter and Bank Have Keys: Access to a safe deposit box typically requires two keys: one held by the box renter and the other retained by the bank. Both keys must be used in conjunction to open the box, ensuring that no single individual can access the box without authorization.

- Modern Access Methods: Some banks and credit unions use advanced security technologies, such as digital keypads or biometric scanners, to enhance access control. These modern systems provide additional layers of security by requiring specific codes or biometric verification, such as fingerprints or retina scans.

Note on Insurance

While safe deposit boxes offer a high level of security, it’s important to remember that the contents are not automatically insured by the bank. To ensure full protection, you should check with your homeowners or renters insurance provider to see if your policy covers items stored in a safe deposit box. If not, you might need to purchase additional coverage to protect your valuables and documents from loss or damage.

Overall, the combination of physical security, surveillance, and dual control access makes safe deposit boxes a highly secure option for safeguarding your most important and valuable possessions.

How Much is a Safe Deposit Box?

As a bank safe buyer who does not consider leasing safes, it’s important to understand the financial implications of renting a safe deposit box compared to purchasing a personal safe. Here’s a detailed discussion on the costs associated with safe deposit boxes:

Discussion of Safe Deposit Box Costs

Factors Affecting Cost

- Size: The cost of a safe deposit box is primarily influenced by its size. Smaller boxes are generally less expensive, while larger boxes, which offer more storage space, come with a higher price tag. For individuals with extensive storage needs, investing in a larger box will increase the annual rental cost.

- Bank’s Pricing: Different financial institutions have varying fee structures for safe deposit boxes. Banks and credit unions set their prices based on factors like their location, the level of security provided, and any additional services. Institutions with premium security features or added conveniences may charge higher fees.

Average Annual Cost Range

- Typical Range: Renting a safe deposit box usually costs between $30 and $300 annually. Smaller boxes in less expensive areas fall at the lower end of this range, while larger boxes or those in high-demand locations are at the higher end. The cost reflects the size and the specific pricing policies of the financial institution.

Importance of Comparing Prices at Different Banks

- Cost Variability: Since safe deposit box prices can vary significantly between institutions, it’s crucial to compare options to find the best deal. Evaluating the size of the box, the security features, and the overall cost will help ensure you get value for your money. Searching for terms like “safe deposit box near me” can help identify local options and their respective costs.

Consideration for Bank Safe Buyers

- Buying vs. Leasing: As someone who focuses on purchasing bank safes rather than leasing safe deposit boxes, it’s worth noting that buying a personal safe can offer long-term cost savings compared to annual rental fees. While renting a safe deposit box may be convenient and provide high-security benefits, purchasing a safe provides permanent storage at your location, eliminating ongoing rental costs.safes rather than leasing safe deposit boxes, it’s worth noting that buying a personal safe can offer long-term cost savings compared to annual rental fees.

- Initial Investment vs. Long-Term Costs: Purchasing a safe involves an upfront investment, but it can be more cost-effective over time compared to continuous rental fees. Additionally, owning a safe gives you control over its placement, accessibility, and security features, which might align better with your needs if you prefer not to lease.

By understanding these factors and comparing the cost of renting versus buying, you can make an informed decision that best suits your security needs and budget.

Conclusion

In summary, a safe deposit box offers a secure and reliable method for storing valuable items and important documents. Here are the key benefits and considerations associated with using a safe deposit box.

Benefits of Using a Safe Deposit Box

- Enhanced Security: Safe deposit boxes are housed within vaults equipped with thick walls, strong doors, and complex locking mechanisms. This level of security provides protection against theft, fire, and other environmental risks.

- Reliable Access: Safe deposit boxes offer controlled access, requiring both the renter’s key and the bank’s key (or modern access methods) to open the box. This dual-control system ensures that only authorized individuals can access the contents.

- Variety of Sizes: With options ranging from small to extra-large boxes, safe deposit boxes can accommodate a wide range of storage needs, whether you’re safeguarding important documents, valuables, digital storage devices, or family heirlooms.

- Advanced Features: Many banks and credit unions offer modern access methods, including key cards and biometric systems, which enhance the security and convenience of accessing your safe deposit box.

I strongly recommend getting a quality safe deposit box to protect your cash,Important Documents and valuable items.